The rise of video streaming services was discussed during a meeting on tech trends before the CES International consumer technology conference held in Las Vegas earlier this month. Photo: Associated Press

By Michael R. Malone

The Golden Globes annually light the fanfare fuse that sizzles all the way to the Oscars on Feb. 9. At the Globes ceremony this year, host Ricky Gervais used his pulpit, in twisted fashion, to skewer the very actors and industry that the awards were meant to celebrate.

“No one cares about movies anymore, nobody goes to the cinema, nobody watches network television, everyone watches Netflix,” said Gervais, as part of his caustic comedic schtick.

Like the films we love best, Gervais’ take isn’t exactly true—yet there’s plenty of truth in it. Netflix, for example, garnered a leading 24 nominations in Oscars’ competition announced this week, spotlighting the growing rift between old and new Hollywood.

Ana Francois, an assistant professor in the University of Miami School of Communication who worked for years in the film industry, uses a “3D matrix”—competition, quality, and delivery options—to explain the dynamics that are revolutionizing the film and TV marketplace.

“Gone with the Wind,’’ released 80 years ago, is still the highest-grossing box office film of all time,” Francois said. “People went to the movies more often then, partly because they didn’t have the other forms of entertainment, either in or out of the home, that we do today,” she added.

“Just as the music business has been forced to change by the concerts, festivals, and new venues, slowly cinema has been changed by this new competition” said Francois, who, prior to joining the University in 2013, worked in the television distribution unit at Universal Studios and at Metro-Goldwyn-Mayer, focusing on film and TV for European and Latin American markets.

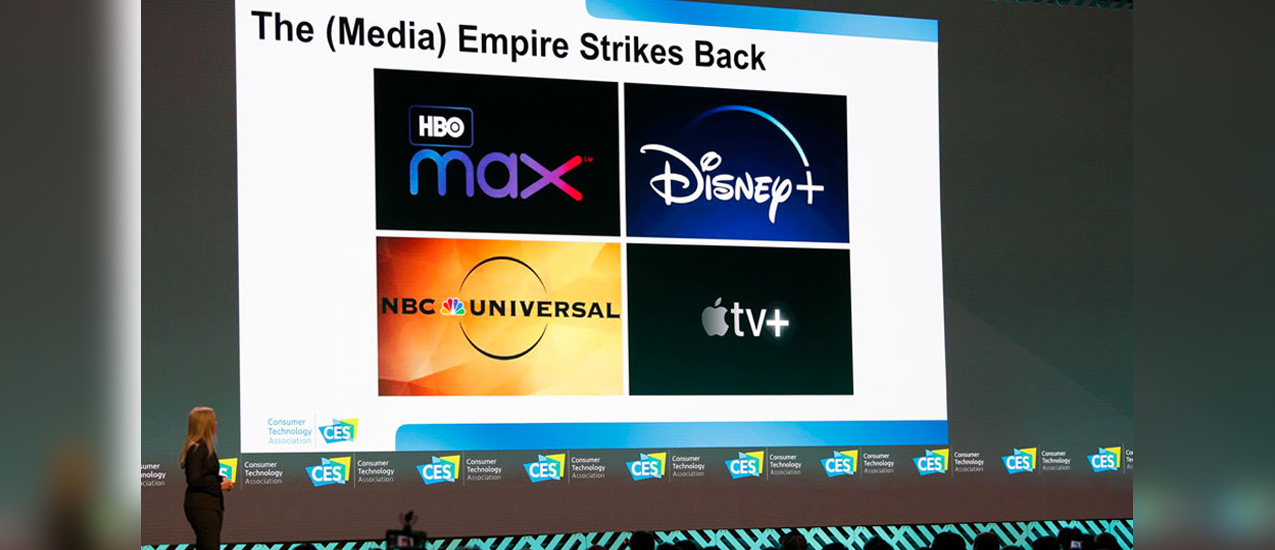

The proliferation of new live-streaming services and alternatives to traditional pay TV is driving the competition, she explained. In the past two years, Amazon, Apple, AT&T, Discovery, Disney, NBC Universal, and WarnerMedia have all launched streaming video services, joining steady streamers like Netflix and Hulu.

New technologies and digitalization have spurred an uptick in content quality. “The quality is better than it’s ever been,” Francois pointed out. “When I first started in the industry, there was a distinction between the quality of films and television content. Today, compare ‘The Crown’ and ‘Game of Thrones’ with feature films and, basically, you can’t tell the difference in terms of production values.”

While Francois believes that viewing habits have changed, she noted that “10 years ago traditional Hollywood could not comprehend how watching movies on a phone’s small screen would become the new normal.”

Tywan Martin, an associate professor in the Department of Kinesiology and Sport Sciences, tracks the influence, persuasion, and impact of media messages on these viewing habits and consumer behavior.

“Millennials—the most coveted group in sports and entertainment—have more control over the market than they realize,” said Martin, who grew up tracking the theatrics and shenanigans of his favorite wrestlers together with his dad, a wrestling coach.

“The companies used to be good at directing wrestling audiences into what they should be thinking. But over the course of time, the fans revolted and became the ones dictating who they believed the ‘good guy’ and the ‘heel’ were,” he said.

Martin noted, too, how consumers’ influence shifted the format of ESPN’s flagship SportsCenter program. For years after it launched in 1979, the show’s producers determined the highlights they wanted viewers to see. Yet with the rise of social media platforms, viewers began to seek the sports clips they wanted to see. “The folks were no longer watching the show, because they’d already seen the highlights,” Martin said. SportsCenter shifted its format to regain its footing.

“Consumers were ultimately dictating how business is done,” Martin acknowledged. Yet, he cautioned that the appearance that consumers are in control is deceptive. “What’s happening is that consumers aren’t realizing that they are conditioning their condition,” he said.

Martin referred to the “condition” that consumers believe they are deciding on their content. Every consumer choice they make is tracked, and that data is amassed to generate algorithms that are reflected back and that ultimately narrows their choices.

The associate professor said that he recently binge-watched a Netflix program with a primarily African-American cast. Then, the next time his program selections were displayed, they were all programs with African-American casts. He then watched a different show with a primarily Caucasian cast and, again, all his choices were for similar shows.

“It almost freaked me out,” he said. “I like to believe that I’m open-minded and well-rounded, but that requires me to be conscious of stuff like this occurring so I don’t fall into a trap.”

The Motion Picture Association of America, the industry’s voice, celebrates the new diversity of outlets and options as the golden age of storytelling. MPAA figures for 2018 showed that the combined theatrical and home entertainment market revenue was $96.8 billion, up 9 percent from 2017 and up 25 percent from 5 years ago. Home entertainment and global consumer spending, meanwhile, rose 16 percent to $55.7 billion, while U.S. spending grew by 12 percent. More than 80 percent of U.S. adults watch movies and television via traditional services, while more than 70 percent watch via online subscription services.

Digital home entertainment is the growth driver. Global consumer spending grew 16 percent to $55.7 billion, while U.S. spending grew 12 percent, according to a Theatrical Home Entertainment Market Environment report.

But bricks in Hollywood’s golden castle are beginning to crumble. Movie ticket sales for the U.S. and Canada will total $11.45 billion, a 4 percent decrease from 2018, according to The New York Times, and viewers’ appetite for live and streaming seems only whetted.

While reports of the death of the box office are greatly exaggerated, there’s a squeeze at the box office and it’s not to get in the ticket line, at least not for mid-sized films.

“The 2019 box office top 10 was dominated by Disney or Marvel Studios and were either sequels, prequels, or remakes,” said Francois, adding that “the industry in general is polarizing more and more between micro-budget content and more mega content—and the middle is kind of losing its appeal for now.”

The era of networked communication and transmedia entertainment has radically changed where and how people are watching movies. Nevertheless, whether on the big or smaller screens, movies still serve a noble purpose: to bring us together, challenge our assumptions, and inspire us.